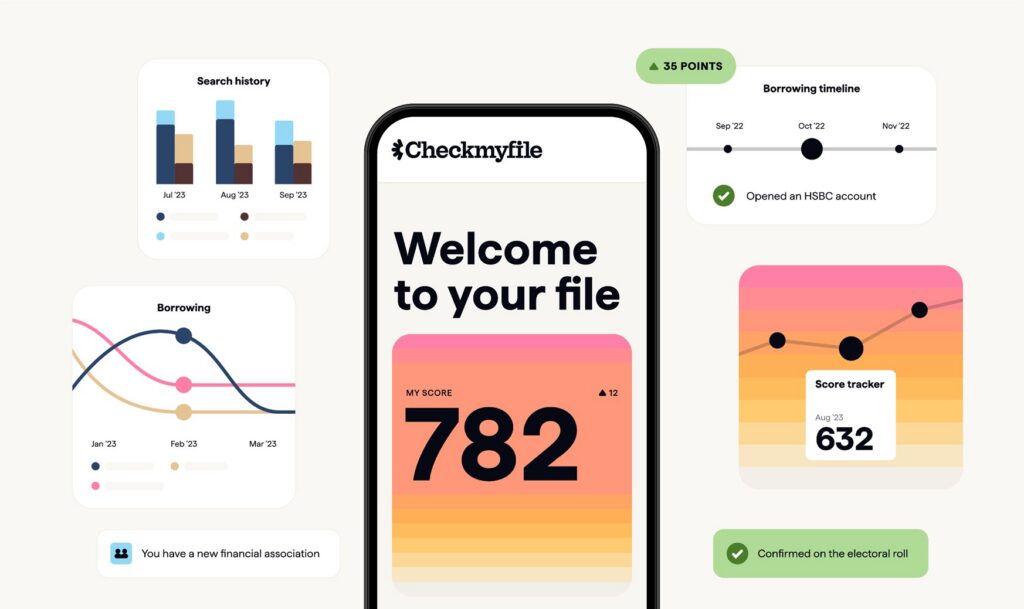

“When big life moments depend on your ability to borrow money, your credit score can feel daunting. By collating data from Experian, Equifax and TransUnion, we help you know where you stand and how to grow. Whatever your number, whatever your goal.”

- Checkmyfile

Keep On Top of Your Credit Score

Keeping on top of your credit score betters your chances of getting a mortgage. That’s why we’ve partnered with Checkmyfile so you can get your full, detailed credit report in minutes. Curious to see yours? Sign up for your credit report here. It’s free for 30 days, then a monthly fee of £14.99 applies – cancel online at any time.

What is Checkmyfile?

There’s no single credit report, no single credit score. The credit reference agencies can all have slightly different data and different ways of calculating a score. Checkmyfile makes sense of it – bringing all the data into one place, showing everything a lender might see when you apply for a mortgage. By collating data from Experian, Equifax and TransUnion, Checkmyfile generates your comprehensive credit report over the last 6 years. From joint accounts to registering to vote, Checkmyfile lets you see it all.